Study finds extreme weather can influence mortgage payments

The findings suggest that weather-related variables need to be considered when assessing mortgage risk.

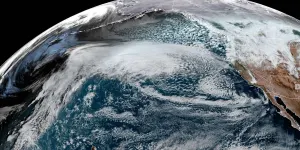

Can your ability to pay your mortgage be impacted by extreme weather events, such as cyclones and floods? According to new research by a team at the University of Edinburgh, the answer is yes.

Researchers looked at data from nearly 70,000 mortgages and more than 3.5 million payments to analyze the impact of heavy rains and tropical cyclones on mortgage risk in Florida.

They found the intensity of a tropical cyclone significantly heightened the likelihood of a borrower defaulting on their payments -- and the strength of the cyclone appears to matter.

People whose properties were hit by cyclones that were a category three or stronger had more than double the risk of defaulting on payment compared to those whose properties were hit by a category two storm.

Coastal communities also could be at risk.

The study found people were less likely to pay their mortgages early in flood-prone areas experiencing heavy rain, especially for properties along shorelines.

The findings suggest that weather-related variables need to be considered when assessing mortgage risk.

Header image: Made using graphical elements found in Canva Pro by Cheryl Santa Maria.